Two months after disclosing plans to sell Otezla® (apremilast) as part of its planned $74 billion acquisition of Celgene, Bristol-Myers Squibb (BMS) has found a buyer for the drug in Amgen, which has agreed to acquire global rights to the psoriatric arthritis and plaque psoriasis treatment for $13.4 billion cash.

The deal is subject to BMS and Celgene entering into a consent decree with the U.S. Federal Trade Commission (FTC) in connection with the companies’ pending merger, the closing of the merger, and other customary closing conditions.

“This agreement represents an important step toward completing our pending merger with Celgene,” BMS chairman and CEO Giovanni Caforio, MD, said in a statement.

On June 24, Caforio and BMS revealed plans to sell Otezla as part of its Celgene acquisition, citing what it called “concerns” raised by the FTC about the blockbuster deal.

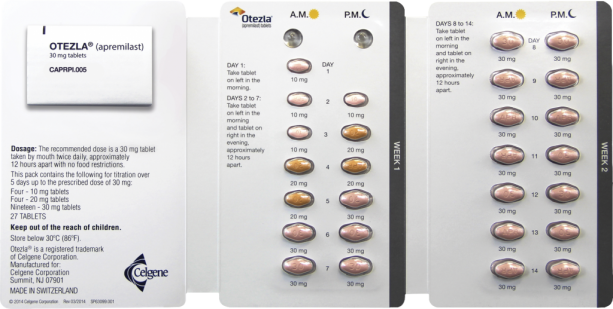

Otezla is an inhibitor of phosphodiesterase 4 (PDE4) that is indicated for adults with active psoriatic arthritis; patients with moderate to severe plaque psoriasis who are candidates for phototherapy or systemic therapy—and as of last month, adults with oral ulcers associated with Behçet’s Disease.

BMS has its own psoriasis drug candidate in development, BMS-986165. In September 2018, BMS trumpeted positive Phase II results for BMS-086165, saying that the tyrosine kinase 2 (TYK2), inhibitor met the primary endpoints of the IM011-011 trial (NCT02931838) by delivering ≥75% and 90% reduction in the Psoriasis Area and Severity Index (PASI 75, PASI 90), respectively, following 12 weeks of treatment with ≥3 mg daily of the drug candidate.

Since then, BMS has advanced BMS-986165 into a registrational program consisting of two Phase III trials, POETYK-PSO-1 (NCT03624127) and POETYK-PSO-2 (NCT03611751). BMS is also assessing the efficacy and safety of BMS-986165 compared with placebo in people with active psoriatic arthritis in a Phase II trial that is estimated to enroll 180 patients (NCT03881059).

$1.9B in 2019 sales projected

Otezla is Celgene’s third-best-selling marketed treatment, having generated $882 million in net product sales the first half of this year, up 21% from $728 million in January–June 2018. Otezla racked up $1.608 billion in sales last year, up 26% from 2017, and Celgene has projected 2019 net product sales for the drug of $1.9 billion—a guidance for investors it left unchanged last month.

An acquisition of Otezla would deepen the inflammatory disease treatment portion of Amgen’s portfolio, since the biotech giant already markets a blockbuster drug for various arthritis indications and plaque psoriasis, Enbrel® (etanercept). In the first half of 2019, Enbrel generated sales of $2.514 billion, up 4.4% from $2.407 billion a year earlier. But for all of 2018, Enbrel sales fell 8%, to $5.014 billion from $5.433 billion, a decline Amgen blamed on declines in demand and price.

In its statement announcing the Otezla sell-off, BMS stated it now expects to close the Celgene acquisition by the end of 2019. That’s later than BMS’ original expectation that its blockbuster acquisition would be completed in the third quarter—but more optimistic than BMS’ forecast that the deal would be completed “at the end of 2019 or the beginning of 2020.”

Amgen has agreed to acquire Otezla and related intellectual property, including any patents that primarily cover the drug, as well as other assets and liabilities related to Otezla, BMS said. The agreement includes the transfer to Amgen of Celgene employees primarily dedicated to Otezla.

“Together with the Otezla team, Amgen has the capabilities and infrastructure to continue to support this important medicine and ensure a seamless transition for patients and healthcare providers,” Caforio added.