August 1, 2012 (Vol. 32, No. 14)

Recent Survey Finds Commercial-Stage Use of Disposables Continuing on Upward Trajectory

Bioreactors are constantly evolving, with improvements being introduced rapidly. To assess how the industry will be adopting and using some of these new technologies, at both clinical and commercial manufacturing scales, we asked more than 300 biomanufacturers their approaches to adoption of these new technologies.

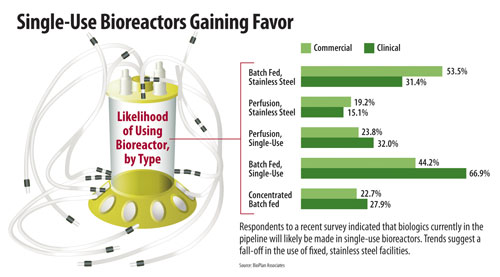

The results, contained in BioPlan Associates’ 9th Annual Report and Survey of Biopharmaceutical Manufacturers, suggest that biologics currently in the pipeline will likely be made in single-use, disposable bioreactors. Respondents indicated a clear preference for these devices, and it is likely they will be overtaking fixed, stainless facilities in the near term.

One of the questions in this year’s study asked respondents to list the bioreactor types they would specify for a new facility for clinical- or commercial-scale biologics manufacturing planned for operation two years from now.

For clinical scale, two-thirds (66.9%) of our respondents expect to implement batch-fed single use bioreactors. This compares to 31.4% who would choose batch-fed stainless steel bioreactors. With single-use bioreactors already dominating many areas of precommercial, including clinical supplies and the manufacturing market, it is no surprise that these would be predominantly specified for future clinical manufacture.

It is notable, however, that only slightly more than half (53.5%) would specify batch-fed stainless steel bioreactors for commercial manufacture, as batch-fed stainless steel currently dominates the commercial stage. This result may indicate an increased willingness on the part of the industry to adopt single-use systems or otherwise abandon batch-fed stainless steel systems for commercial manufacture.

In fact, a significant 44.2% said they would specify single-use batch-fed bioreactors for future commercial manufacture. This result may be impacted by the industry’s general perspective, also identified in our global study, that the vendors and new product innovators of single-use devices will resolve some of the nagging problems associated with adoption. These include leachables and extractables concerns, standardization issues, and breakage problems.

Single-Use Bioreactors Gaining Favor

Perfusion Bioreactors

The study also found that single-use perfusion bioreactors were a more popular choice than stainless steel perfusion bioreactors, at both clinical and commercial scale. Slightly less than one-third (32%) of respondents would expect to implement single-use perfusion bioreactors at clinical scale, more than double the 15.1% who would implement stainless steel perfusion bioreactors. And while the disparity is not as great at the commercial scale (23.8% specifying single-use perfusion bioreactors vs. 19.2% specifying stainless steel perfusion bioreactors), the trend clearly favors the disposable solution.

Focus on Disposable Bioreactors

Although it is noteworthy that single-use batch-fed bioreactors were chosen by a significant proportion of respondents for commercial-scale manufacturing in two years, this result becomes less surprising when viewed from the perspective of new product development demands.

Identifying new product development areas of focus is a worthy indicator of which way the industry is headed, and the data from our study confirms that biopharmaceutical manufacturers are demanding more and more innovation in disposable solutions, and seem to be less motivated by advances in stainless steel equipment. In other words, data shows that the industry sees disposable solutions differently, and they are pushing vendors to develop enhanced solutions to meet their needs.

This year, of the 21 different new product development areas of interest evaluated, disposable solutions accounted for three of the top five areas of interest, led by demand for new and better disposable bags and connectors. Interest in disposable bioreactor innovation has grown from last year, though it remains behind levels from 2010.

For comparison’s sake, of the new product development areas we identified, stainless steel occupied the 19th spot. Just one in ten respondents consider this to be an area they want their suppliers to focus their development efforts on. Certainly, this is in part because stainless steel equipment is more mature than many of the other areas we identified. However, it also illustrates that the industry may be less concerned with refining this existing equipment and far more interested in developing new areas.

Whether or not traditional processes are converted to fully single-use, a hybrid system, or not converted at all (and simply replaced post-depreciation), our report’s results certainly appear to support the trend toward increased single-use adoption. And, at least when it comes to bioreactor types, it appears that this move may come at the expense of traditional stainless steel systems.

Eric S. Langer ([email protected]) is president and managing partner at BioPlan Associates.