March 1, 2011 (Vol. 31, No. 5)

Sector Exceeded Analysts’ Expectations in 2010, and 2011 Looks to Bring Strong Growth as Well

Following a strong 2010, we believe the life science tools and diagnostics industry could continue to perform well in 2011.

Performance from companies in this industry was strong in 2010. Median revenue and earnings grew 6% and 13.5%, respectively, compared to 4.5% and 7.5% growth in 2009. This performance exceeded analyst expectations, and quarterly revenue and earnings upside averaged 2% and 3%, respectively, for the group. This outperformance was driven largely by those companies with a greater mix of tools as opposed to diagnostics, as demand for analytical tools grew more strongly than expected on the strength of an economic recovery.

The stock returns for companies in the Leerink Swann Life Science Tools & Services index nearly doubled the S&P 500 in 2010. Performance of the Diagnostics index was more in line with the S&P 500.

Drivers for increased demand for analytical tools included strength in both academic as well as industrial/applied markets. Academic demand rebounded from 2009 levels, due to strength from stimulus monies worldwide. In the U.S., the American Recovery and Reinvestment Act (ARRA) contributed an additional $3.5 billion in CY2010 funding to the $31 billion baseline NIH budget. Other countries, particularly Japan, funneled stimulus funds into research projects as well.

Industrial and applied markets also fared well. The industrial recovery is evident by the rebound in GDP growth of many nations. The median GDP growth rate for a group of six countries (U.S., U.K., France, Germany, China, Japan) was 3.2% in 2010, up from -3.7% in 2009. Applied markets (i.e., applications of research tools in nonresearch settings) also enjoyed strong growth, headlined by an increased focus on food safety, especially in China.

We believe the appetite for research tools among large pharmaceutical companies was muted in 2010, though did not worsen from 2009 levels. Most suppliers have described this market as heterogeneous, with pockets of growth from some customers and declines from others. The research appetite from small biotech companies picked up due to an improved funding environment.

The biotech funding environment improved markedly in 2010. Data from both Burrill & Co. and BioCentury suggest that biotech fundraising in 2010 reached its highest level in years, while BioCentury’s data suggests that fundraising in 2010 fell only slightly short of levels reached during the 2000 biotech bubble.

Notable IPO activity in the Life Science Tools and Diagnostics industry included the U.S. IPO of molecular diagnostics company GenMark Diagnostics in 1H 2010 as well as the IPOs of sequencing companies Pacific Biosciences and Complete Genomics late in the year.

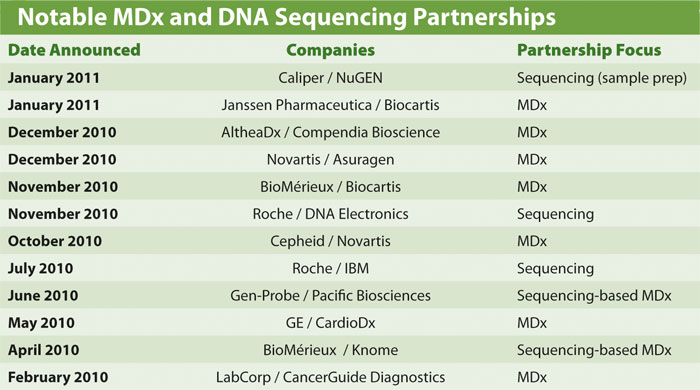

Companies also pursued partnerships in areas of mutual interest, particularly in molecular diagnostics and DNA sequencing. The Table illustrates some notable partnerships in these areas that were consummated in 2010 and thus far in 2011.

We’ve also seen several large mergers both consummated and announced in 2010 and thus far in 2011. Notable transactions include Danaher/AB Sciex/Molecular Devices, Agilent/Varian, Merck KGaA/Millipore, GE Healthcare/Clarient, Thermo Fisher Scientific/Dionex, and Novartis/Genoptix.

One trend in 2010 that caught many by surprise was the impact of falling healthcare utilization on diagnostic companies. While the large jump in U.S. unemployment occurred between 2008 and 2009, when the unemployment rate jumped from 5.8% to 9.3%, diagnostic suppliers suffered from the resulting drop-off in utilization with a COBRA-generated lag. Additionally, after the swine flu scare in 2009, seasonal flu in 2010 was comparatively nonexistent, which further reduced doctor visits.

Looking into 2011, we expect many of the trends witnessed in 2010 to persist. Demand for research tools in academia should remain strong due primarily to continued disbursements of U.S. stimulus funding. However, in a time of soaring budget deficits, investors are watching Obama’s FY2012 budget request closely. The White House seeks to protect investments in biomedical research, and we expect the budget request could show continued support for biomedical research funding, but opinions differ widely. Additionally, concern over government research support in Europe has been a hot topic, though it appears that research has been spared the axe in several countries already (e.g., U.K., Spain, France).

We expect industrial/applied markets will remain a source of strength in 2011. Economists polled by Bloomberg predict median GDP growth will exceed 2% in 2011 in the U.S., U.K., France, Germany, China, and Japan. In the applied markets, food testing remains a hot topic and growth area following the passage of the Food Safety Modernization Act in the U.S.

Research spending at large pharmaceutical companies could remain flattish at best, as another $70 billion in branded drugs should lose patent protection between 2011 and 2015. Smaller biotech may help pick up some of the slack if capital markets remain robust.

Economists polled by Bloomberg expect the U.S. unemployment rate will remain north of 9% in 2011, suggesting that a sharp rebound in healthcare utilization could be unlikely. However, performance for diagnostic companies could improve in 2011 on easier year-over-year comparisons as well as a greater incidence of seasonal flu.

We expect partnerships in and around sequencing and molecular diagnostics will continue. Additionally, we believe M&A activity will remain high. Room remains for plenty of consolidation within the life science tools and diagnostics industry, and participants from outside the industry have become increasingly interested in these assets as well.

John L. Sullivan ([email protected]) is healthcare investment strategist, and Dan Leonard ([email protected]) is senior research analyst at Leerink Swann.