May 1, 2012 (Vol. 32, No. 9)

Contract manufacturing organizations (CMOs) continue to expect a great deal more from their employees than they have in the past, results from BioPlan’s latest survey of 302 biomanufacturers and CMOs suggest. In fact, data from the “9th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production” indicates that, when compared to biotherapeutic developers, CMOs are far more prone to emphasize productivity measures specifically related to their staff.

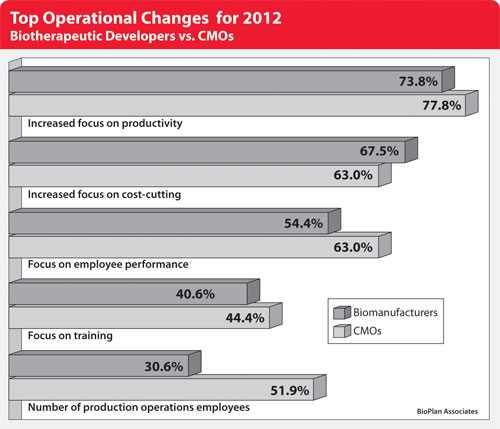

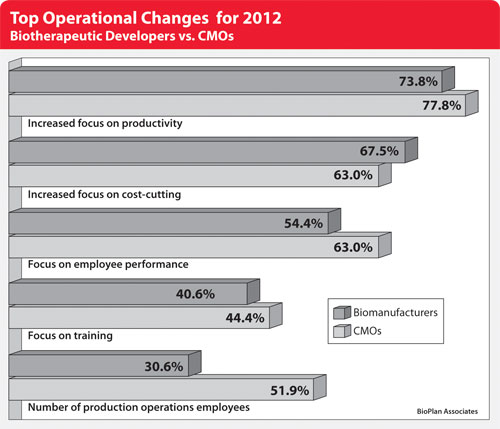

From the survey, the top operational changes planned by CMOs this year due to recent global economic conditions center on productivity. In fact, 77.8% of CMOs said this year that they will be placing “somewhat greater” or “much greater” focus on this area. And while 63% will focus more on cost-cutting, that proportion is rivaled by those who will be focusing more on employee performance.

Biotherapeutic developers are in agreement when it comes to a greater focus on productivity this year, with 73.8% indicating they will be placing either somewhat or a much greater focus on this area (Figure). Beyond this top-line agreement, though, some keen differences emerge.

On the one hand, biodevelopers are more likely to be increasing their focus on cost-cutting (67.5% vs. 63%) and regulatory functions (45.6% vs. 33.3%). On the other, CMOs are more likely to cite a greater focus on employee performance (63% vs. 54.4%), an upswing in the number of production operations employees (51.9% vs. 30.6%), and increased emphasis on employee training (44.4% vs. 40.6%).

Partly because of the CMO business model, which allows pass-through expenses to their clients, when it comes to cutting costs, CMOs are less likely than biodevelopers to make changes in the hiring department (18.5% vs. 26.3%). They are also more likely to cut funds for manufacturing process improvements (22.2% vs. 18.1%) or for adoption of new technologies (18.5% vs. 14.4%). These results suggest that CMOs’ greater focus on productivity this year is tied to the expectations they have for their employees’ performance.

When comparing the data to last year, we find a general consistency in themes. An increased focus on productivity topped the list of changes for CMOs last year also (83.9%), while a greater focus on employee performance (71%) took the second ranking, ahead of an increased focus on cost-cutting (67.7%). Similar discrepancies existed between CMOs and biodevelopers when looking at the focus on employee performance, as with the number of production operations employees.

Figure: Top Operational Changes for 2012

Employee Improvements

One reason why CMOs may be more focused than biodevelopers on the productivity of their employees is because they attribute significant performance improvements to better operations staff training. This year, when we asked for respondents’ opinions on the top factors creating either some or significant improvements to their biomanufacturing performance, we found that an impressive 73.1% of CMOs cited “better operations training,” compared to 50.6% of biodevelopers.

In fact, this factor ranked behind only “improved downstream production operations” (84.6%) for CMOs, and was on par with “overall better control of process,” and “optimized cell culture processes.”

Responses to these questions varied significantly between biotherapeutic developers and CMOs, with the product manufacturers reporting more frequent implementation of process-related improvements. One might expect CMOs, with their high project turnover and need to do it right, quickly, and the first time, to be out in front of product manufacturers in terms of implementing process improvements. However, we may be seeing the result of increased FDA concerns and fallout from major pharmaceutical manufacturing failures widely reported in the news, with these widely publicized problems placing more demands on product manufacturers and FDA.

CMOs remain predominantly involved in smaller-scale R&D and clinical supplies manufacture, where regulatory manufacturing-related requirements are less strict and there have been few prominent reports of CMO biopharmaceutical product manufacturing failures.

More biotherapeutic developers found increased performance from:

- Better process control (65% vs. 57.7%),

- Better analytical testing and product release services (65% vs. 53.8%),

- More automated control of processes (52.5% vs. 42.3%),

- Improved existing quality management systems (QMS) (55% vs. 46.2%), and

- Improved validation services (45% vs. 38.5%).

CMOs found relatively greater performance improvements from:

- Improved downstream production operations (84.6% vs. 64.4%),

- Optimized cell culture processes (73.1% vs. 62.5%),

- Improved upstream production operations (73.1% vs. 63.1%),

- Optimized media (65.4% vs. 52.5%), and

- Better plant design (61.5% vs. 46.3%).

More than two-thirds of CMOs are forecasting an increase in funding for training of operations staff over the next 12 months. [Maximilian Stock/Photo Researchers]

Increasing Budgets for Staff, Training

CMOs apparently are not afraid to back up their focus on employees with real money. An impressive 70.4% are forecasting an increase in funding for training of operations staff over the next 12 months, including roughly one-third that will increase their training budgets by more than 10%.

In fact, operations staff training trails only new capital equipment (81.5%) and new technologies to improve efficiencies and costs for upstream (74.1%) and downstream (77.8%) in terms of the proportion of respondents planning a budget increase. By comparison, half of the biomanufacturers we surveyed are planning an increase in budgets for operations staff training.

Our data showed that CMOs are placing more of a focus than biotherapeutic developers on hiring more production operations employees (51.9% vs. 30.6%), and respondents’ beliefs regarding budget changes over the next 12 months appear to confirm this discrepancy. 59.3% of CMOs said they will increase their budgets for hiring new operations staff, including 22.2% that will increase their funding for this area by more than 20%. By comparison, 49.4% of biotherapeutic developers plan to up their budgets for operations staff hiring.

Meanwhile, 59.3% of CMOs are forecasting an increase in funding for hiring new scientific staff, including 44.4% that will increase their budgets by more than 10%. By contrast, 43.8% of developers plan to increase their budgets in this area, with roughly half of those planning changes of less than 10%.

Looking Ahead

Our data suggests that demand for operations staff and skilled scientists is going to translate to more hiring this year, particularly among CMOs. Not only that, but existing employees will benefit from increased training, with CMOs and biodevelopers alike looking to reap the rewards of these investments. Indeed, it appears that the hiring freezes of the past four to five years are behind us, and that hiring and other employee-related budgets have returned.

Eric S. Langer ([email protected]) is president and managing partner at BioPlan Associates.