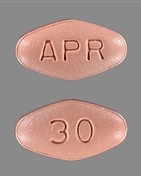

Bristol-Myers Squibb (BMS) plans to divest itself of the psoriasis drug Otezla® (apremilast) as part of its planned $74 billion acquisition of Celgene, in order to address what it called “concerns” raised by the U.S. Federal Trade Commission (FTC) concerns about the blockbuster deal.

BMS acknowledged that its purchase of Celgene will take longer to close than initially anticipated. BMS said in a statement that it now expects completion of its Celgene acquisition “at the end of 2019 or the beginning of 2020,” rather than during the third quarter as predicted when the deal was announced on January 3.

By selling off Otezla, BMS asserted, it would “allow the transaction to close on a timely basis in light of concerns expressed by the FTC.”

The divestiture is subject to further review by the FTC, which will require that BMS sign a consent decree with the agency. Upon FTC acceptance of the consent order and the satisfying of customary closing conditions, BMS said, the deal to acquire Celgene will close.

In Europe, BMS and Celgene have submitted a formal application for clearance by the European Commission after concluding their pre-notification process, the pharma said.

“Bristol-Myers Squibb is committed to working with regulatory authorities around the world on the proposed combination with Celgene,” BMS stated. “The company is focused on realizing the promise of the transaction, and is continuing to work to complete the transaction on a timely basis.”

BMS has touted the “value creation opportunity” presented by its purchase of Celgene. In addition to the combined company’s pipeline and portfolio of marketed products, BMS has also acknowledged that the deal will lead to approximately $2.5 billion in cost cuts or “synergies,” though it continues to expect growth in sales and earnings through 2025.

$1.6B in 2018 sales

Otezla is Celgene’s third-best selling marketed treatment, having generated $1.608 billion in 2018 sales, up 26% from 2017. Otezla’s sales momentum slowed in the first quarter of this year, when it generated $389 million, up 10% from Q1 2018.

However, BMS is developing its own autoimmune disease drug candidate, BMS-986165, for indications that include psoriasis. In September 2018, BMS trumpeted positive Phase II results for BMS-986165, saying that the tyrosine kinase 2 (TYK2), inhibitor met the primary endpoints of the IM011-011 trial (NCT02931838) by delivering ≥75% and 90% reduction in the Psoriasis Area and Severity Index (PASI 75, PASI 90), respectively, following 12 weeks of treatment with ≥3 mg daily of the drug candidate.

Based on those results, BMS advanced BMS-986165 into a registrational program consisting of two Phase III trials, POETYK-PSO-1 (NCT03624127) and POETYK-PSO-2 (NCT03611751).

“The company is continuing to develop its promising immunology pipeline asset, tyrosine kinase 2 (TYK2) inhibitor, in several autoimmune diseases, including psoriasis,” BMS stated. “Bristol-Myers Squibb looks forward to advancing its leadership in core areas of focus, including immunology, and delivering highly innovative medicines that bring meaningful benefits to patients as a combined company.”

BMS signaled potential FTC concerns over the combined company’s psoriasis portfolio in a March 25 regulatory filing stating that both it and Celgene received a request for “additional information and documentary materials” from the agency in connection with its review of the deal: “The parties understand that the FTC’s review is focused on marketed and pipeline products for the treatment of psoriasis.”

The blockbuster acquisition is designed to create a powerhouse in immunology and inflammation, cardiovascular disease—and oncology, where both companies had encountered setbacks in the months leading up to their announcing the deal. Shareholders for both BMS and Celgene have approved the acquisition, despite BMS’ lead investor opposing the transaction.