Alkermes has agreed to acquire Rodin Therapeutics for up to $950 million, the companies said today, in a deal that will expand the buyer’s CNS pipeline with first-in-class, orally-available, brain-permeable therapeutics for brain diseases driven by synaptic loss and dysfunction, or synaptopathies.

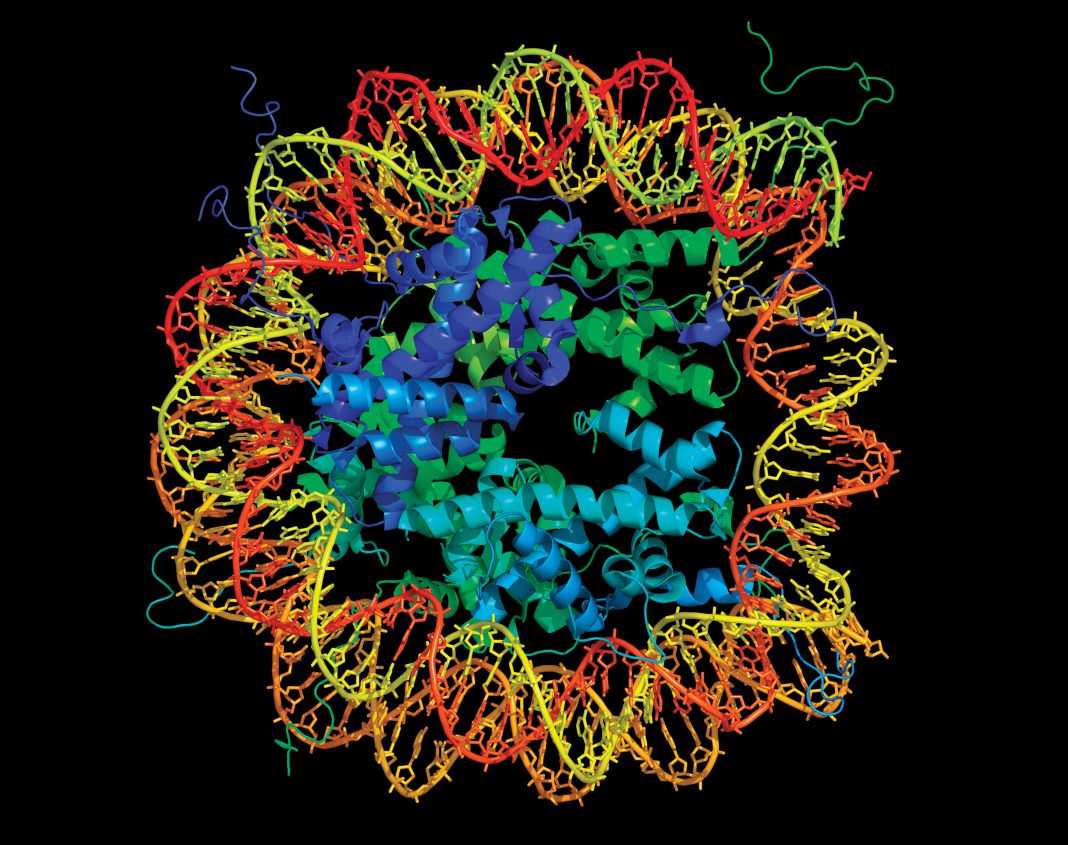

Headquartered in Boston, privately-held Rodin has developed molecules designed to target specific histone deacetylase (HDAC) complexes. HDACs are a class of proteins involved in chromatin remodeling and gene expression, and have been shown to regulate synaptogenesis and synaptic plasticity. However, currently available HDAC inhibitors with known prosynaptic effects cannot be used in the treatment of chronic neurologic conditions, because they are associated with dose-limiting hematological toxicities.

Rodin reasons that selective inhibition of the HDAC−co-repressor of repressor element-1 silencing transcription factor (CoREST) complex can reactivate neuronal gene expression, strengthen existing synapses, and promote the creation of new synapses, while minimizing known class-based hematologic safety concerns. Rodin says that its platform may be potentially applicable to a variety of neuropsychiatric, neurodegenerative, and neurodevelopment disorders, such as Alzheimer’s disease, Huntington’s disease, frontotemporal dementia, and depression—as well as oncology and blood disorders.

“Building on our broad experience in psychiatry, we believe this transaction will allow us to explore a wide array of neurodegenerative diseases and synaptopathies, which have been areas of significant interest to us as we have advanced our internal pipeline of medicines for CNS disorders,” Alkermes CEO Richard Pops said in a statement.

Leapfrogging lead candidate

Alkermes said it intends to advance Investigational New Drug (IND)-enabling activities for lead preclinical assets in Rodin’s pipeline—potentially leapfrogging that work ahead of RDN-929, Rodin’s lead clinical candidate designed to treat synaptopathies.

RDN-929 is a selective inhibitor of the HDAC-CoREST complex whose preclinical safety profile, according to Rodin, should allow long-term dosing as a therapeutic for chronic neurologic diseases. In June, Rodin trumpeted positive results from a Phase I placebo-controlled study (NCT03668314) showing what it called a basis for further development of the compound, including:

- RDN-929 was safe and well-tolerated at all dosage levels and demonstrated favorable pharmacokinetic and pharmacodynamic properties.

- Concentrations of the drug were measurable in cerebrospinal fluid (CSF) and in the predicted range targeted for future efficacy studies.

- The sensitivity and specificity of assays used to assess biomarkers linked to synaptic and neuronal health was confirmed. Neurofilament light chain (NfL), neurogranin (Ng), SNAP25, and PSD95 were quantified in cerebrospinal fluid; NfL and Ng were also measured in plasma.

Alkermes said it also plans to continue Rodin’s preclinical research program focused on the subset of frontotemporal dementia patients with an inherited mutation of the progranulin gene (FTD-GRN) and exploratory work in hematological disorders and oncology.

“Based on the compelling research and the significant progress that Rodin has made to advance its chemistry and understanding of selective HDAC inhibition over the last several years, we are excited to enter this interesting area of research and development at this time,” stated Craig Hopkinson, MD, CMO and SVP of medicines development and medical affairs at Alkermes.

M&A interest after restructuring

The Rodin acquisition comes a month after Alkermes said it would eliminate approximately 160 staffers in a restructuring designed to save $150 million in costs, following a charge of approximately $15 million against fourth-quarter earnings, consisting of one-time termination benefits for employee severance, benefits, and related expenses.

Addressing analysts October 23 during Alkermes’ Q3 quarterly conference call, Pops said the company was “very interested in licensing M&A particularly to expand the development portfolio. We’re very interested in licensing M&A to leverage the commercial infrastructure that we’re building. And we have internal R&D that’s beginning to bear fruit that we’ll continue to fund.”

Alkermes agreed to pay Rodin security holders $100 million cash upfront upon the closing of the transaction—which is expected by the end of this month—and up to $850 million in payments tied to Rodin’s development candidates achieving clinical and regulatory milestones, and sales thresholds.

The upfront payment is expected to be funded by Alkermes’ available cash; the company finished the third quarter of this year reporting $608.533 million in cash, cash equivalents, and total investments, down 1.9% from $620.039 million as of December 31, 2018.

The upfront payment will be accounted for as an asset acquisition, with substantially all of it recorded as R&D expense, Alkermes said. The buyer said it expects to incur approximately $20 million of incremental R&D expenses in 2020 related to the advancement of Rodin’s development candidates.

Alkermes said it will provide a complete 2020 financial forecast in February 2020.

“With its proven ability to develop novel medicines for the treatment of CNS disorders, we believe Alkermes is ideally suited to advance this exciting new approach to neurologic diseases and bring potential new treatment options to patients that may benefit from Rodin’s synaptogenic platform,” added Rodin CEO Adam Rosenberg.