By Denise Golgher PhD and Roberto Rodrigues Pinho

Much has happened since American surgeon and cancer researcher William Colley made the first observations that gave rise to the field of tumor immunology. That was in the 1890s, and the following century has been extremely fruitful in terms of our increased understanding of the molecular basis of immune responses and genetics of cancer. This knowledge, associated with new laboratory reagents and equipment, allowed for advances on clinical research that have led to unprecedented commercial excitement around immuno-oncology.

Tipping the balance in favor of the immune system in the battle against cancer is big business. The biggest pharmaceutical companies—for example, AstraZeneca, Johnson & Johnson, MSD, Merck, Novartis, Sanofi, Pfizer—are all investing in internal programs and/or in partnerships with biotechnology companies and research institutes.

Sealed Deals

In 2015, Novartis increased its immuno-oncology pipeline by purchasing Admune, a developer of cytokine drugs for cancer immunotherapy. It also signed agreements with the Spanish company Palobiofarma for its adenosine A2A receptor antagonist, offering an upfront payment of $15 million. Novartis also closed a deal of $37.5 million (that can go up to $480 M) with Xoma for rights to its antitransforming growth factor-beta (TGF-β) antibody program. Surface Oncology entered into a collaboration on immunotherapeutics with Novartis worth $170 million in upfront capital, equity, and near-term milestones.

Baxalta agreed to a deal of $1.6 billion with Symphogen to co-develop six experimental drugs for checkpoint inhibitors. The acquisition of Baxalta by Shire was announced in January 2016. Incyte and Agenus launched a collaboration, worth as much as $410 million, that focuses on checkpoint modulator antibodies (GITR, OX40, LAG3, and TIM-3). Agenus has also established a collaborative deal with MSD worth upwards of $100 million. CureVac licensed its mRNA vaccine rights to Boehringer for a potential $600 million. Sanofi and BioNTech launched an alliance to enable mRNA delivery in vivo of $1.5 billion.

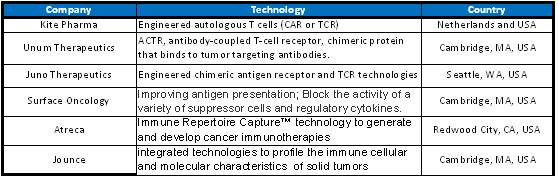

These nonexhaustive examples show how competitive the immuno-oncology market has become, and the odds are good that more deals will be announced in 2016. The number of startups developing new technologies in the field is overwhelming, thanks to venture capitalists bets (Table 1).

Kite Pharma and Juno Therapeutics received record series A investments and announced initial public offering very early, with just under five and two years of their foundation, respectively. Kite, founded in 2010, completed $35 million in series A investment. Juno raised a record $120 million of initial investment capital and completed $176 in round A investments. The former has several collaborations with other companies, including Amgen, and the latter has already announced a ten-year collaboration with Celgene. Jounce Therapeutics received $47 million in series A investments in 2014. Unum, the youngest of the four, received series A investment in 2014 of $12 million and closed a deal with Seattle Genetics that could net as much as $645 million.

Though much excitement came from the exceptional results with CAR (chimeric-antigen receptor) technology, monoclonal antibodies that block the checkpoint inhibitors, anti-CTLA-4, and anti-PD1 were only the beginning of the checkpoint frenzy. Many of the recent deals involve companies developing technologies for additional checkpoints.

Table 1. Immuno-oncology companies that received venture capital investments.

Ongoing Clinical Trials

In November of 2015 there were 450 open studies on cancer immunotherapy registered at clinicaltrials.gov, the vast majority of them in phases I and II. An analysis of these trials indicated a huge variety of studies. Cell therapies (autologous or heterologous), T cells, NK cells, γδ T cells, dendritic cells, macrophages, and oncolytic viruses are all being tested for several different cancers. The FDA-approved monoclonal antibodies pembrolizumab, nivolumab, ipilimumab, tremelimumab, and avelumab for the checkpoint inhibitors CTLA-4 and PD1/PD-L1 are being tested extensively on their own or, more frequently, in combination treatments—additional checkpoint inhibitors, cell therapies, tumor-specific antigens, heat shock proteins, T-cell apoptotic regulators, toll-like receptor agonists, and so on.

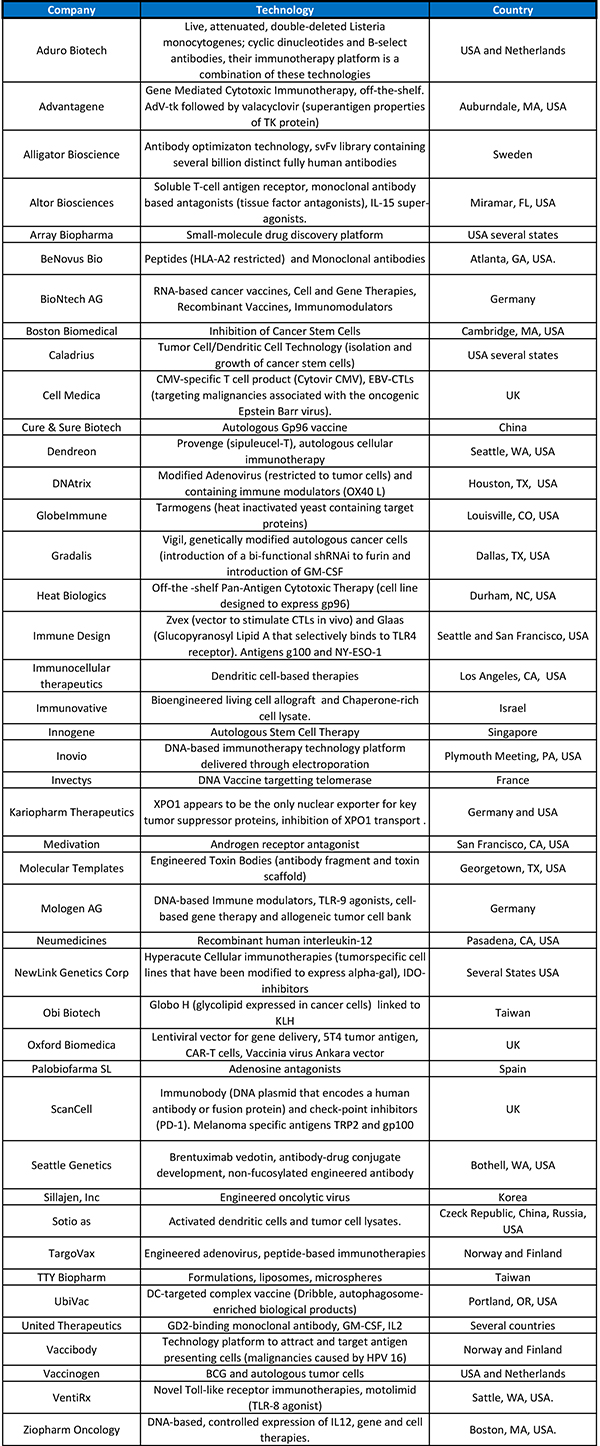

Removing the breaks of the immune system is not being limited to the use of monoclonal or modified antibodies. Cyclophosphamide, rapamycin, and IDO (indoleamine-2,3-dioxygenase) inhibitors are all being studied. Among these, cyclophosphamide appears most frequently in the ongoing trials. Table 2 shows the variety of technologies and respective companies developing them.

The analysis of the clinical trials can suggest that everything is being explored to make the immune system respond to different cancers (Figure 1). As expected, there were more trials using cellular therapies being sponsored by research institutions, but more trials combining small molecules and approved chemotherapeutics and antibodies in the industry-sponsored trials.

The market excitement with immuno-oncology is also stimulating the development of interdisciplinary technologies—treatments in which new biomaterials, electroporation equipment, gene therapy, photodynamic therapy, biomarker identification, and the difficult field of carbohydrate analysis and function are being tested together to create better and more precise treatments. Patients will certainly benefit from what will be learned from these studies during the next decade.

Table 2. Clinical trials in cancer immunotherapies sponsored by private companies.

Patenting Immuno-Oncology Inventions

The immuno-oncology area relies on a strong patent system. As the business evolves and new cancer treatments get marketing authorization, obtaining patents before other patent offices worldwide will turn out to be an essential part of the business. The overheated cancer immunotherapy market patent framework is not only complicated, but shakes day after day as companies divulge that they have successfully obtained patent protection for their breakthrough inventions.

Juno’s agreement with Novartis to settle CAR T-cell technology patent litigation lawsuits is just the beginning of what is expected to be an era of disputes between innovators. The scenarios are developing, and soon there will be several players holding key patents for different cancer immunotherapies.

For instance, in December of 2015, Apogenix, a German-based biopharmaceutical company developing immuno-oncology therapeutics, obtained the notice of allowance by the U.S. Patent Office of its patent directed to APG101. APG101 is a fully human fusion protein that consists of the extracellular domain of the CD95 receptor and the Fc domain of an IgG antibody. APG101 is being developed for the treatment of solid tumors (glioblastoma) and malignant hematological diseases.

We expect 2016 to be a year in which many more patents covering immuno-oncology inventions will be examined and granted worldwide. (A thorough study dedicated solely to the patents related to immune-oncology has to be addressed in another article.)

Though many believe it is unlikely that the immune system will be able to reject (on its own) a growing tumor, results indicate that it can be of crucial importance during treatment—surgical, chemotherapeutic, and radiotherapeutic. In the near future it may be possible to select a combination treatment that will bring the most benefit to the individual. While most of this is “business as usual,” the hope is that, after the painful stages of surgery/radiation/chemotherapy/immunotherapy, the immune system will be able to perform its job as a good surveyor of health efficiently, and the number of people leading a good life after a diagnosis will continue to rise.

Denise Golgher PhD, is head of patent practice and Roberto Rodrigues Pinho is a partner at Licks Attorneys.