July 1, 2013 (Vol. 33, No. 13)

Emerging Market Predicted to Double in the Next Five Years to Well Over One Billion Dollars

Metabolites have been used as biomarkers for decades. The presence of sugar in urine for diabetes may be their oldest application, but in the past five or six years, their occasional use has become the discipline of metabolomics. This attention to metabolites is resulting in a growing number of biomarkers that is transforming the industry.

“It’s difficult to dissect ‘biochemistry’ from ‘metabolomics’ in research. Where classical approaches end and ‘metabolomics’ begins is something of a philosophical question,” notes Anthony Walker, Ph.D., partner, Alacrita.

However, “It is probably fair to say the value of metabolomics will be as surrogate markers of active protein pathways, which may help guide more targeted analysis of gene and protein expression to discover new targets and disease markers. In terms of drug discovery, the main area of focus has been monitoring toxicology studies and predicting their outcomes.”

According to Dr. Walker, the next five years will see a continued focus on the central relevance of regulatory pathways across all therapeutic areas and their relevance to the production of metabolites.

“Essentially all of biology is regulated by proteins interacting with substrates to manifest a particular biological event—nucleic acid transcription and translation, protein and amino acid recycling, energy transfer, anabolic processes, catabolic processes, active transport, et cetera,” he continues.

“Metabolomics provides a selected view of the end-products of a set of these processes. That will be an important addition to knowledge but, in the near term, may be a relatively poor substitute for measuring the protein pathways and their activation status directly.

The big change, as he sees it, is the realization that such pathway analysis applies to neurobiology as much as to oncology, metabolic disease, inflammation, etc.

“Systems biology approaches are likely to become much more prominent. It’s clear that everything interacts, and much historic progress has been made on the basis of reductionism,” Dr. Walker says.

That approach has yielded breakthroughs, “but ultimately, a holistic, systems-wide approach will be needed to explain the huge degree of biological complexity,” he explains, while suggesting that making tangible advances in metabolomics may require another 20 years of research.

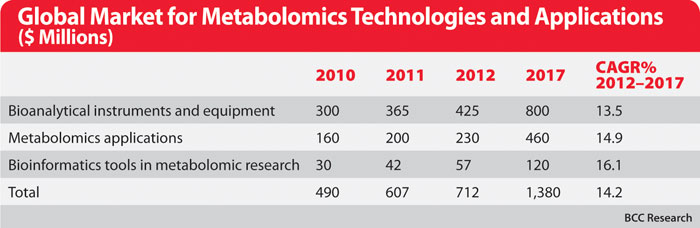

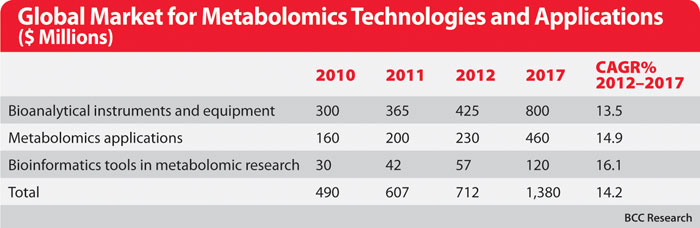

Global Market for Metabolomics Technologies and Applications ($ Millions)

Market Outlook

Nonetheless, the overall outlook for the metabolomics market is positive, according to Marianna Tcherpakov, Ph.D., market research analyst, BCC Research. “We estimated it as an emerging market with a current value of $712 million and project it will almost double itself (to $1.38 billion) within the next five years.”

This growth will be driven by the realization that, “Like other omics, a metabolomics approach has big impacts in research and product development, especially in the area of biomarker and drug discovery applications,” Dr. Tcherpakov elaborates.“With advancements in genomic, transcriptomic, and proteomic data collection and analysis, it seems logical for a metabolomics discovery study to consider adding results from those whenever possible.”

Applications extend beyond biotech to include such novel markets for metabolomics as biofuels, nutrigenomics, agriculture, and food safety. The greatest opportunities, however, are in pharmaceuticals and diagnostics. The metabolomics market is segmented into biomarker discovery, molecular diagnostics, and drug discovery.

Application of biomarkers in drug discovery and preclinical studies of drugs and diagnostics accounts for the major share of the market. Specifically, Dr. Tcherpakov says, the most prominent applications are for “toxicology and safety assessments, drug metabolism studies for pharmacokinetics, and biomarker discovery for monitoring or diagnosing disease.”

In terms of therapeutic areas, oncology constitutes the largest market segment, followed by central nervous system and cardiovascular system disorders.

“Metabolomics applications may be the next blockbuster category in this industry,” considering the growing interest in personalized medicine and wellness, Dr. Tcherpakov says.

“However, its influence on the market is at a very preliminary stage.” As the market expands, drug development applications will continue to be important, and diagnostics will become the other primary driver, she says. “The application of metabolomics in clinical biomarker development will play a significant role in market growth.”

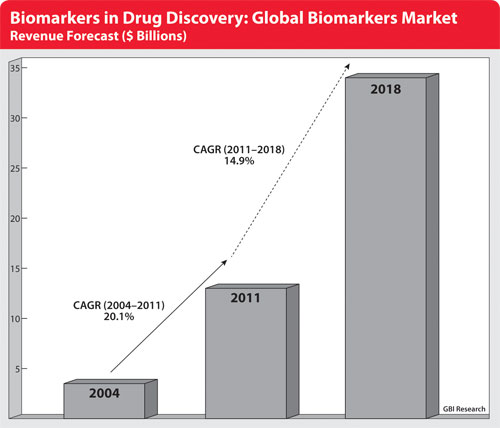

Biomarkers in Drug Discovery: Global Biomarkers Market Revenue Forecast ($ Billions)

Expanding Product Lines

Although numbers of diagnostics products based on metabolomics will increase, Dr. Tcherpakov says she doesn’t envision new diagnostic developers entering the marketplace. Instead, she suggests existing providers will expand their product lines and industry/academic collaborations will grow.

The two greatest limitations to the growth of metabolomics, according to Dr. Walker, are bioinformatics and research funding. “There aren’t enough trained bioinformaticians available,” he notes.

As metabolomic data accumulates, more sophisticated integration tools for bioinformatics and systems biology must be created to better apply the resulting knowledge. Developing instrumentation and software capable of rapidly processing hundreds of metabolites quickly and efficiently is one of the key challenges in the drug development sector. Proper characterization of unknown metabolites is another hurdle.

Yet, as data accumulates, managing and integrating that information seems to be the most important challenge. Ultimately, “it is crucial to understand the relevance of certain compounds and how they relate to specific biological process in order to proceed further with product and drug development. New bioinformatics and system biology tools are required for that purpose,” Dr. Tcherpakov says.

Companies to Watch

Dr. Tcherpakov couldn’t identify any new stars in the metabolomics space, but says “there are interesting companies with novel technologies and products such as Liposcience and Stemina Biomarker Discovery.

BG Medicine is also a rising contender. “If its cardioscore diagnostic test is approved by FDA, it will put this company in a much better position on the market, especially in the diagnostic area,” Dr. Tcherpakov adds.

The current key players will continue to dominate the space, she predicts.

“Metabolon, Biocrates Life Sciences, and Metanomics are the main leaders in the metabolomics space. They are active in many aspects of this market: diagnostics product development, profiling services, academic collaborations, and even acquisitions.

“Chenomx and Human Metabolome Technologies also are very important. Other leading firms include Avogadro, BG Medicine, and SiDMAP.

Biomarkers

A different survey, conducted by GBI Research, reports radically different market figures. In it, biomarkers, a special subset of the metabolomics market, had a global value of $14.9 billion in 2012, up from $3.5 billion in 2004, according to Geetika Munjal, analyst for GBI Research. That amounts to a CAGR of 20.1%.

As BCC Research senior editor Chris Spivey estimates for GEN, “the current figure for the total biomarker market is at around $20 billion.” Metabolomic applications, however, are estimated at $230 million for 2012.

The difference, Spivey explains, is that, “You can have biomarkers for all sorts of things—heart failure, insulin levels, CNS breakdowns, genomics, proteomics, and, of course, metabolites. The BCC report only considers the segments for metabolomics and, within that niche, only the subset of activity around metabolomics biomarkers.”

The three most important challenges faced in developing and adopting biomarkers for personalized medicine are regulation, reimbursement, and awaren ess, according to Munjal. Differences among biopharma and diagnostic company business models and timelines also pose important hurdles as companies form partnerships to develop tests for drugs that are already approved or are in the pipeline.

“To make their alliances (with bio pharma companies) work, diagnostic companies are specializing in fewer therapeutic areas so they can focus on developing tests to fit specific treatment outcomes,” Munjal tells GEN.

Biopharma companies, meanwhile, leverage their sales forces and marketing budgets to promote companion diagnostics throughout their sales networks.

Recently, Eli Lilly & Co. and Pfizer each signed partnership agreements with Dako. Lily’s deal focuses on oncology, while Pfizer’s agreement covers its broad pipeline, Munjal notes. “Partnering is likely to continue, as it helps companies focus on their core competencies,” he adds.

Qiagen is another company to watch, Munjal says. Like Dako, it plays an important role in the personalized medicine space.

Roche and Novartis also have integrated drug and diagnostics division. “These companies understand the global regulatory guidelines for companion diagnostics and guide the partner company through all complexities of co-development,” Munjal adds.

Instrumentation Feeds Advances

According to Marianna Tcherpakov, Ph.D., BCC Research, progress in metabolomics has been fueled mostly by the application of liquid chromatography and high-resolution mass spectrometry.

“These techniques are essential in the routine characterization of several hundred metabolites,” she says. “Improvement in LC/MS, and GC/MS applications are part of the trend. Companies are developing better versions and combinations of existing equipment.”

Bioanalytical instrumentation and equipment constitutes $425 million of the current overall market, according to BCC.

“For example,” Dr. Tcherpakov says, “Thermo Scientific recommends its high-resolution Orbitrap mass spectrometer, available in three versions. These include the LTQ Orbitrap (a hybrid linear ion trap-Orbitrap system), the Q-Exactive (a lower-cost quadrupole-Orbitrap hybrid), and the new Orbitrap Elite, with a mass resolution of over 240,000.”

Likewise, “Agilent Technologies recommends either standard time-of-flight or hybrid quadrupole-TOF instrument for metabolomics research, as both provide the mass resolving power and accurate mass measurements that are key for deducing the precise elemental composition of novel compound. Agilent has four such instruments in its portfolio, the newest of which, the 6550 Q-TOF, is 10 times more sensitive than its closest counterpart, the 6540 Q-TOF.”

Waters, Bruker, Bio-Rad Laboratories, and Human Metabolome Technologies are also key contenders in the metabolomics instrumentation space, adds Dr. Tcherpakov.