November 15, 2011 (Vol. 31, No. 20)

Market Review and Opportunities

Molecular diagnostics are well-established in clinical medicine. Nonetheless, the markets for these tests remain one of the most attractive growth opportunities in the in vitro diagnostics industry. Approximately 600 hospital laboratories and 200 independent laboratories perform high-volume testing that necessitates both automated molecular diagnostic testing platforms and systems that simplify and accelerate sample preparation. Additionally, new molecular diagnostic tests are regularly introduced to the market for screening or diagnosing a wide range of patient types for numerous diseases.

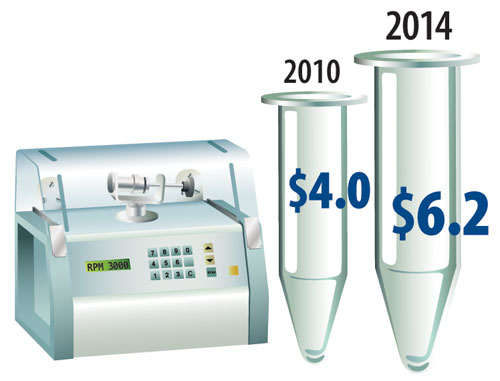

Revenues from worldwide sales of molecular diagnostics were estimated to total $4,079.7 million in 2010 and are expected to reach $6,209.8 million by 2014 with a compound annual growth rate (CAGR) of more than 11%.

Historically, the use of molecular methods was constrained by their cost and labor-intensive nature, stemming from the fact that they are error-prone and their operation requires skilled laboratory personnel. However, costs-per-sample and manual requirements have fallen with the adoption of novel genomics technologies and improvements in automation.

In addition to logistical benefits, new technologies and assays have expanded the areas where testing can be applied. To successfully leverage this testing expansion, manufacturers are employing targeted strategies for particular testing use. The two most common applications for molecular diagnostics are for identification and profiling of causative agents of infection and to quantify pathogens to monitor durability of therapy. Beyond these, molecular diagnostics are quickly expanding for genetic testing, prenatal diagnostics, cancer diagnostics, and near-patient applications.

More than 75% of the molecular diagnostics market is controlled by nine companies: Roche Diagnostics, Qiagen, Gen-Probe, Abbott Diagnostics, Siemens, Becton Dickinson, Cepheid, bioMérieux, and Beckman Coulter. Roche is the undisputed market leader with almost 30% share and an unparalleled product portfolio, which includes molecular diagnostic tests for oncology, virology, microbiology, and blood screening.

Qiagen’s growth rate has outpaced competitors over the past three years, with a CAGR in excess of 21.3%. Emerging from primarily a sample-preparation technology and PCR reagent vendor, the company has aggressively expanded its business to the extent that now approximately half of its sales come from molecular diagnostics. Similarly, Gen-Probe’s growth rate has outpaced the industry average given the company’s global market leadership in chlamydia and gonorrhea (CT/NG) testing.

Sales of molecular diagnostic tests for infectious diseases generate approximately 60% of overall molecular diagnostics market revenues. Fittingly, market participants largely focus on developing and marketing infectious disease molecular diagnostics, which primarily include tests for human immunodeficiency virus (HIV), HPV, hepatitis B and C (HBV/HCV), and CT/NG. With the exception of the HPV molecular diagnostics market, most of these testing areas are very mature with growth rates settling around 5%.

HPV testing, however, remains an enormous market opportunity with growth rates expected to remain as high as 20% through 2014. In 2010, approximately 16 million HPV molecular diagnostic tests were conducted worldwide, generating close to $400 million in revenues. Even though the cost-per-test is expected to decline as testing volume increases, this market is forecasted to be as large as an $800 million market by 2014.

While growth of the HIV, HBV/HCV, and CT/NG molecular diagnostics markets are low in comparison to HPV, clinical trials are under way that could significantly influence market dynamics. For example, studies are being conducted to demonstrate the value of using molecular diagnostics instead of immunoassays for HIV screening. Although such guideline changes are likely to be deemed unfeasible due to the high costs associated with molecular testing, any changes in screening practices could positively influence the market.

Beyond HIV, HPV, HBV/HCV, and CT/NG, companies are quickly introducing molecular diagnostic tests for many other infectious disease indications. For example, some of the infectious disease molecular diagnostics relatively new to the market include those for West Nile Virus, Clostridium difficile (C-diff), methicillin-resistant Staphylococcus aureus (MRSA), respiratory syncytial virus, influenza, pneumonia, Trichomonas vaginalis, genital mycoplasma, herpes simplex virus, norovirus, rotavirus, tuberculosis, and meningitis.

Among these, the two tests for diagnosing nosocomial infections, or healthcare-acquired infections (HAIs)—C. Diff and MRSA—have witnessed the greatest level of adoption. With direct medical costs attributable to HAI totaling as much as $34 billion in the U.S., molecular diagnostic-based screens are proving to be necessary for risk mitigation. By promoting infection prevention and control, U.S.-based molecular diagnostic testing for C. Diff and MRSA generated $140 million in 2010.

Revenues from worldwide sales of molecular diagnostics were estimated to total $4 billion in 2010 and are expected to reach $6.2 billion by 2014, with a compound annual growth rate (CAGR) of more than 11%.[Frost & Sullivan]

Congressional leaders have also been trying to do their part to fortify diagnostic development. Despite four prior attempts not making it past committees, Rep. Anna Eshoo (D-CA) is working to introduce a revised Genomics and Personalized Medicine Act while the current 112th Congress is in session. The Personalized Medicine Coalition has been helping Rep. Eshoo put together the new legislation, and has identified six priorities for advancing the measure further than past versions. Click here for details.

Jonathan Witonsky ([email protected]) is a principal analyst in the life sciences research group of Frost & Sullivan.